To continue the counterfeit discussion from our October issue, I recently connected with Oshri Cohen, CEO of Cybord, to discuss advancements in both counterfeit detection and data analytics.

To hear Oshri describe Cybord’s work is to realize that real-time counterfeit detection technologies can also contribute directly to improving process windows in production.

Nolan Johnson: Oshri, you’ve been with Cybord for about two years now. What led you to join the company?

Cybord’s Accurate One-Two Punch Oshri Cohen: I was vice president of supply chain

at NVIDIA, and vice president of operations at Mellanox for 15 years until it was acquired by NVIDIA. In 2022, I left NVIDIA where I was responsible for the production, quality, manufacturing procurement, and every aspect related to the board execution itself and for the data center division at NVIDIA. That amounted to around 10 million boards every year. It’s an interesting activity; you learn a lot across the spectrum of quality and manufacturing.

I came to Cybord because I could bring that customer perspective.

Cybord had fantastic technology, but it was not fine-tuned to exactly what a customer really needs. Now, I

think we are better synced with the customerצpain points, and we see the results. It’s a different story now.

Our October issue of SMT007 Magazine focused on counterfeiting, and this month we’re talking about the evolution of data analysis on the manufacturing floor. Cybord lives in both of those spaces.

Correct. Cybord utilizes data for many purposes, one of which is counterfeit detection.

First, though, let’s talk about the data. This industry is quite conservative. We’re not running toward new technology adoption or capabilities, and even if they have the opportunity to collect data, someone still needs to do something with it. The industry is not excellent at interpreting and analyzing this data.

However, I do see a great improvement.

Both EMS suppliers and OEMs are looking for more data to draw conclusions about their performance. They want feedback about their products, whether it’s design-, quality-, or even

security-related.

Data can definitely supply these needs. Connecting counterfeiting data? Yeah, that’s obvious. If you collect all the data the way that we collect it, exactly for 100% of your components, you can supply the image of the component and answer questions like, “Who is the manufacturer? What is the date code? What are the quality trends per supplier?”

While we do the analysis, we provide a score for each and every component. We are then able to indicate the exact score for every component, collect it all together, and provide a score for each board.

The score for a board and a product can teach you a lot. As we see more components, our ability to indicate a counterfeit is significantly higher. Today, we have 5 billion components in our database, so a component that we don’t already know is rare. If we find one, it takes about a week to map it, and then all the information that we can provide for this component has a lot of value for the end customer.

The same information we use for counterfeit detection is used for different purposes, like Approved Vendor List (AVL) enforcement.

One of our biggest customers, for example, provided us with the AVL, and we enforced the AVL for him. What does it mean? We look at every component and recognize who the manufacturer is. If there is no match between the AVL and the manufacturer, we raise a flag and indicate an “AVL Violation”

We have seen different components being assembled outside of the AVL more than once, and that’s a problem. It means you are not using qualified components, and that’s another

use case we are doing with this data in collecting every component.

Not only are you executing the black and white decision between legitimate and counterfeit, but you’re also tracking a

finer-grained consistency.

Counterfeit is rare, especially when you work with the biggest ones. Why? Companies like NVIDIA are not buying from the open market, but from franchise distributors or direct from the manufacturer. What are the chances that

some franchises will provide them with counterfeit components?

That would be very rare.

So, the risk is not there, but these same people would like to make sure that the AVL is being enforced. It’s a more advanced perspective not just counterfeit detection but a broader perspective.

I’ve seen in Cybord’s development work that counterfeit detection is easy. It happens at incoming inspection: The part is good, or it’s not. What opportunities has Cybord been putting into the middle and end of the manufacturing process to find counterfeits and improve quality through your manufacturing supply chain?

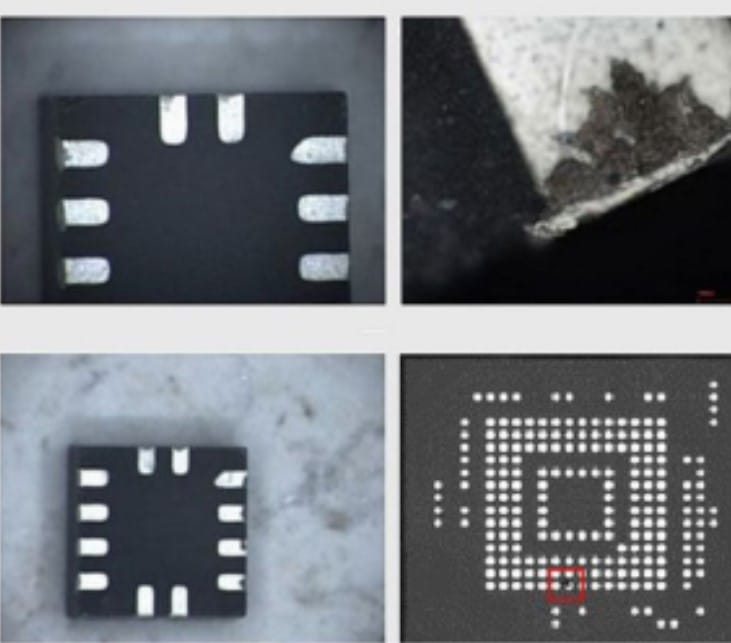

Our software integrates with existing equipment, and this is one of our main benefits. We connect to the pick and place machines at the beginning of the assembly process and to the AOI machines at the end. From this, we get two perspectives: The pick-and-place provides the bottom-side view of all the components, and the AOI provides us with the top-side information. With this, we cover all the components on both sides.

Looking from the bottom, you can recognize defects, cracks, broken parts, bent leads, and contaminations. You can see counterfeit components mainly from the bottom, not from the top. The top side includes the top marking,

which is easy to fake. From the bottom side, we see the leads, their coverage, the shape of the corners, and the texture. This is very hard to counterfeit, so the bottom side is the right place to look for counterfeit details.

You’re creating a lot of data through the whole process, so how do we make sense of that data?

Let’s say that you’re a procurement guy, and you are paying for one manufacturer. You pay for a capacitor at 3x the lowest competitor because you think they are better quality.

Cybord thinks these assumptions shouldn’t matter anymore. You have data to use; if you compare the so called high quality supplier with the second-tier supplier, you can compare the two and make sure that paying 3x is worth it. Most of the time, I can tell you it’s not. But let’s look at the actual data, which is an important analysis that couldn’t happen before. We can do it now because they have the data.

In another example, a customer says, “I have a small board and I’m struggling to place all the small components because the density is just unbelievable.”

Now, the problem is that every supplier provides spec limits. For every component, we have to consider the broad spec limits so the component can meet these limits. But when you measure every component which we do during the analysis you realize that the components converge on a very narrow tunnel within the middle of the spec, not at the edges of thespec. Designers are looking to get this kind of data, but they’ve been unable to because, without a system analyzing the data for them, they can’t make the right decision.

At Cybord, you can’t just create the data and leave it up to your customers to determine its meaning. I assume that Cybord is providing tools to assist.

It would be a missed opportunity to just to collect the data and expect the customer to do something with it. We have a business intelligence (BI) engine running above all this, which can slice and dice the information the way they want. They can provide queries to the system, develop their own queries, and ask questions about the data. Sometimes, we just ask our customers, “What are your pain points you would like to resolve? We may be able to resolve them.”

That’s exactly what we’re doing. We interview the customers, get their feedback, and prepare a reporting system or BI charts and reports to provide this information for them.

We need to digest the data because just collecting it can be confusing. It’s time-consuming work to analyze everything, so we usually do this for our customers.

Can the information you’re creating be fed back into the customer’s MES, for example?

How much integration work should they plan to do to bring all of this from Cybord into their manufacturing process?

Since we output tons of data, we go through a standard API, and whoever wants to utilize it, whether that’s an MES some are taking this to the ERP directly—can provide it. The customer can do whatever they want.

Rarely do I find someone excited by adopting a new system or platform they have to learn to use. In fact, they hate it. The point is, if we provide everything by API, they can get the same information using their current system and that’s very important to everyone.

Has Cybord published papers on how these tools contribute to IPC-A-610 compliance?

Yes. The IPC-A-610 is a bible for our system. The spec calibrates all the thresholds, and we are enforcing the rules. So, assuming you decide to implement the system in your line, you’re fully covered by IPC-A-610—Class 1,

Class 3, it doesn’t matter. We have plans to integrate with other systems, and connect to many third parties. By the way, most MESs are proprietary and developed in-house by the EMS provider. We integrate with them as well.

I think the most interesting and exciting integration we are doing today is a system called real-time interceptor (RTI), which means that we will connect directly with the pick and place machine. We get the information from the machine and then give direct feedback while the machine still holds the component in the air all in a few milliseconds. The machine

picks up a component, takes the picture, and sends the picture to the Cybord server.

The REPRINED WITH PERMISSION server runs a very fast analysis using AI algorithms, and then we notify the machine, while it’s still holding the component, whether the part is good or bad.

picture 1

This way we eliminate the chances that any bad component will ever be assembled to a board. The challenge is that the machine must run at its usual pace, so we need to be fast enough to analyze, react, and integrate with the machine. That’s exactly what we’re doing now. We’re starting with Fuji, and then we proceed with ASM machines.

If your customer is using inbound inspection and RTI, they’ll find the components that don’t adhere to the process window. RTI may not necessarily trigger counterfeit detection at the pick-and-place machine, but your finished product ought to be much higher quality, and you should see much better yields because you’re finding problematic components in the moment.

Exactly. It’s a revolution we are bringing to the market. One of the most painful parts as an OEM was managing the production of 10 million boards a year. Every batch was tens of thousands of boards, just to find out at the end that

there was one bad capacitor, and we needed to roll back a hundred thousand boards. That’s a disaster. The line stopped working for two, three, or four weeks just to make the repairs.

With AI, we shouldn’t be doing that anymore, we now have the capability to stop.

Five years ago, if you wanted to determine whether a component was good, you had to choose a golden unit for every component.

That is just not practical. But AI says, “Don’t bring me anything. Just feed me with the images. For the first thousand images, I won’t be able to tell you anything meaningful. But after the first thousand, we have a model.”

That’s the concept.

Is the approach different whether you’re a high-mix, low-volume specialist or a high volume, low-mix facility?

It’s not really important. The analysis is being done on a component level. I don’t care if it’s placed on this board or another board. You can produce two from this type of board and five from the other type of board. As long as you use the same component, I will be able to provide you with the analysis.

That’s an interesting point. An OEM using an assembler with Cybord equipment can benefit from any previous experience that the assembler had with those same components on other projects to identify whether my boards are good.

Exactly. From the initial setup, maybe we will need a week of training before we are able to cover you 100%.